Early stage financing ecosystem building programs

efino supports program managers around the world in designing and running interactive and effective learning and early stage financing ecosystem building programs. They are tailored to the participants’ needs in terms of content, timing, availability, engagement, and goals, ensuring a flexible, practical and impactful experience. For many of the programs, the goal is knowledge transfer and building local approaches with the tools we provide.

Below are components commonly part of a comprehensive program. They can be run together or independently. They have the greatest impact when executed together in a coordinated fashion.

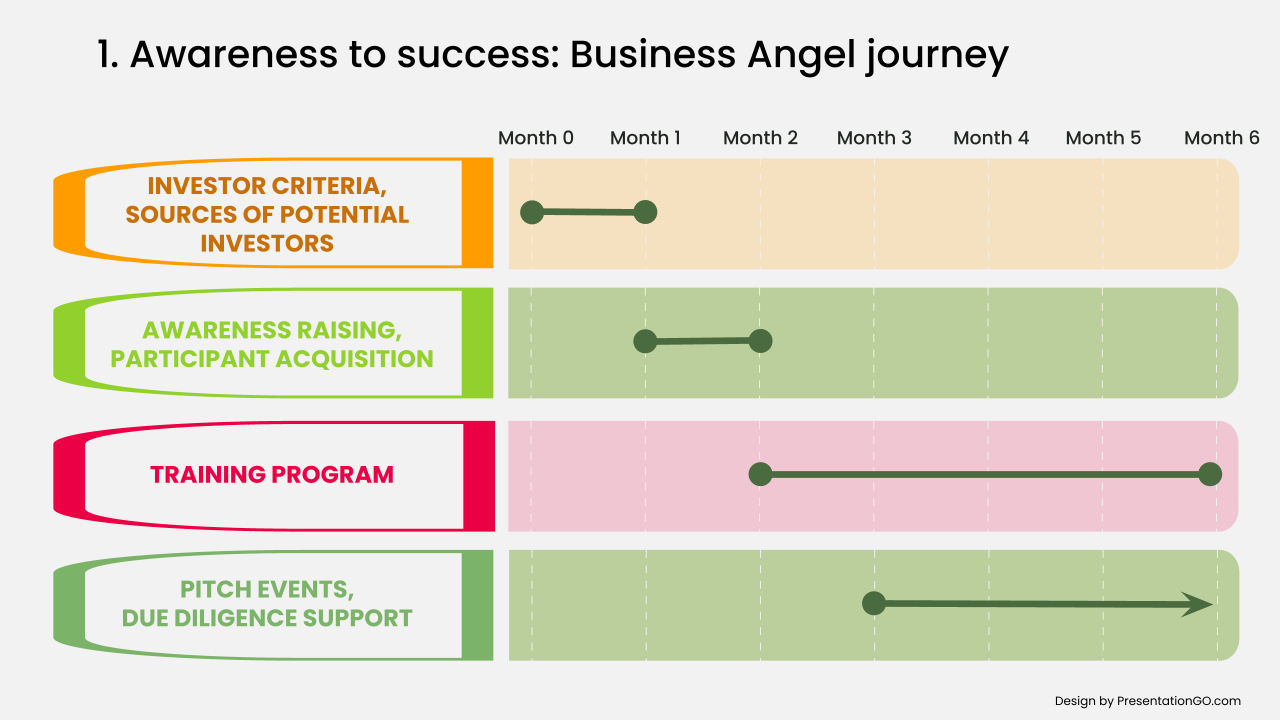

Awareness to success: Business Angel journey

BENEFITS

Participants, both novice and advanced angel investors, learn how to build a diversified portfolio of investments by developing their own investment strategy, selecting the right deals, negotiating terms and making the investment. They can also learn to manage and exit their investments to be successful business angels. Some participants also learn to lead investments where a number of investors syndicate. The participants gain deep learning as they “learn by doing”.

FEATURES

- Identify sources of potential investors and conduct awareness sessions to engage them into the program.

- Assist in participant acquisition, including defining the selection criteria.

- Organize pitch events for investors and entrepreneurs and source deals.

- Provide training programs for novice and advanced angel investors → go to “Investors” to know more about the different options available.

- Support the investment process from due diligence to negotiations and closing for first time investments, follow-on rounds and exiting an investment.

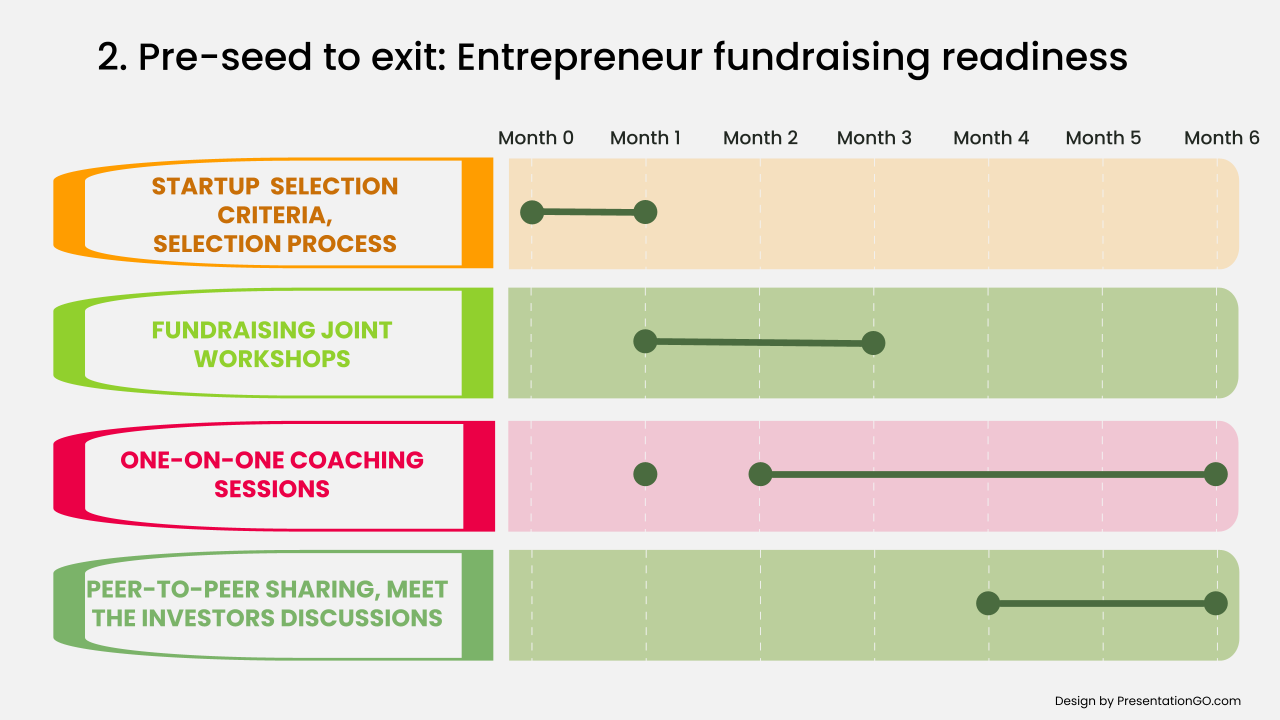

Pre-seed to Exit: Entrepreneur fundraising readiness

BENEFITS

Founders become ready to raise funds by understanding the different financing options available, the specific needs of their company, and the challenges when facing individual investors and VCs. They will build their financing strategy working backwards from exit to their current financing round.

FEATURES

- Define startup and founder selection criteria and run the selection process (sources, how to funnel them in, onboarding…).

- Conduct customized fundraising related workshops → go to “Entrepreneurs” to know more about the different options available.

- Provide one-on-one coaching sessions with experts.

- Facilitate peer-to-peer sharing.

- Organize “meet the investors” discussions.

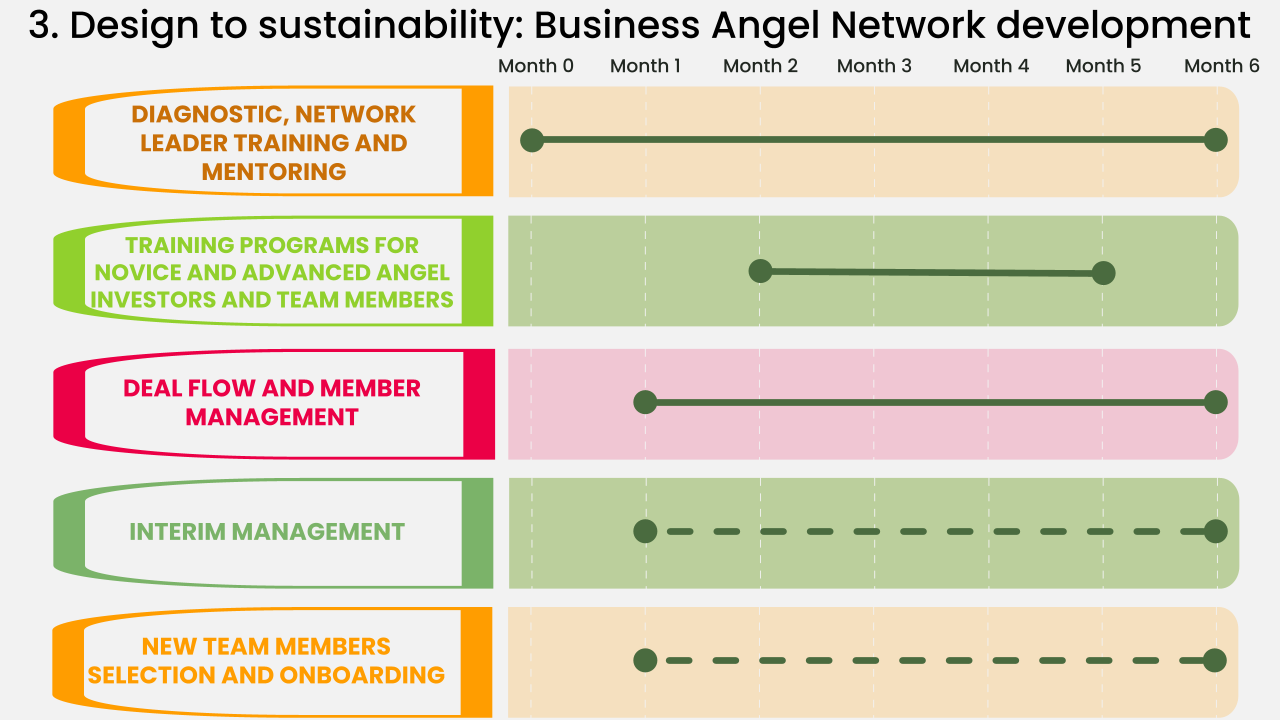

Design to sustainability: Business Angel Network Development

BENEFITS

This program empowers network managers to create robust, well-functioning angel networks that drive impactful investments and foster growth, ensuring long-term sustainability and success.

FEATURES

- Run a diagnostic analysis on the network(s) status.

- Conduct training sessions and one on one mentoring for network leaders covering:

- Key elements of a Angel Network and evolution over time

- Organizational structures and models including economics & roles

- Running an angel community including sourcing, engaging and retaining members, investment process, key operational processes and syndication

- Collaborating with other angel initiatives and ecosystem stakeholders

- Provide training programs for novice and advanced angel investors and network team members → go to “Investors” to know more about the different options available.

- Facilitate deal flow and member management.

- Manage critical day-to-day operational tasks (interim management).

- Identify and onboarding new team members.

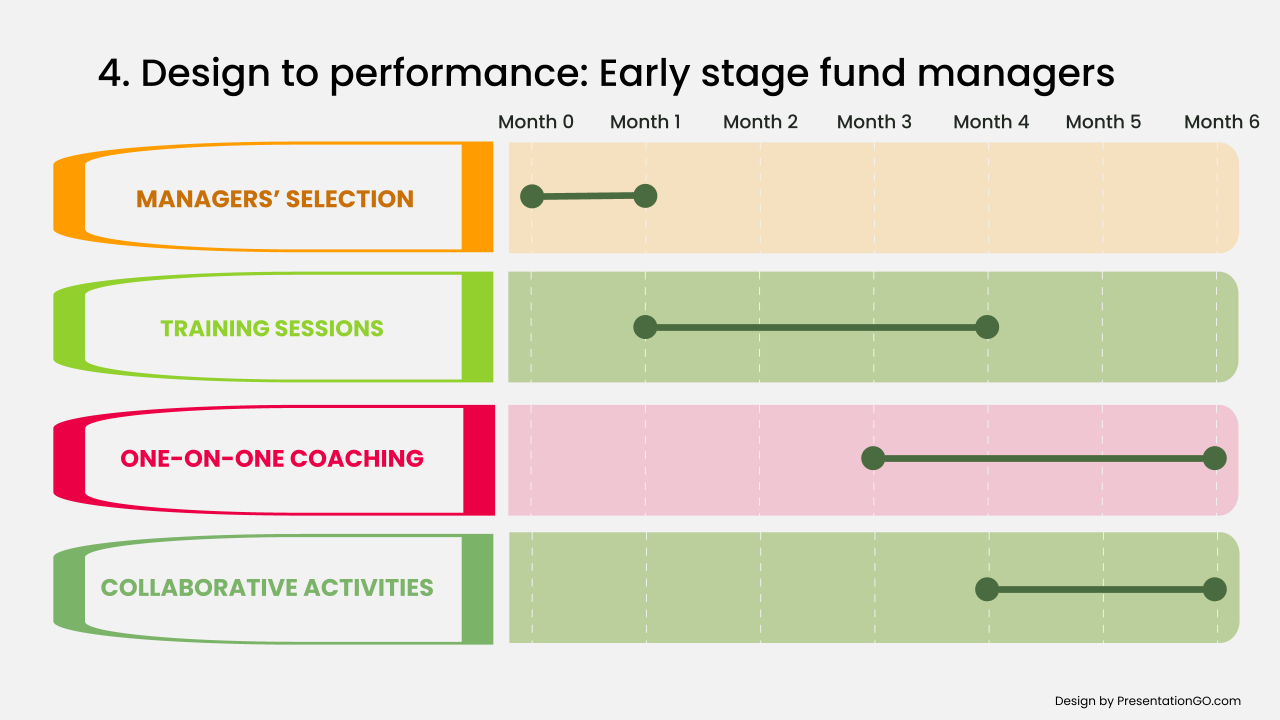

Design to Performance: Early Stage Fund Managers

BENEFITS

This program equips venture capital fund managers with essential skills in fund design, LP identification, program and deal flow management, and exit strategies, empowering them to establish and manage successful funds effectively. It can be customized for individual early-stage funds and typically includes training, coaching, and sample templates.

FEATURES

- Assess and define managers’ skills and strengths, and select suitable candidates.

- Conduct training sessions covering:

- Fund structure and investment strategies

- Techniques for identifying, engaging, and onboarding Limited Partners (LPs)

- Strategies for making strategic investments and building robust portfolios

- Understanding fund economics, including fee structures and carried interest

- Developing exit strategies for portfolio companies and managing fund wind-down

- Provide personalized one-on-one coaching sessions.

- Organize collaborative activities to share best practices and facilitate networking opportunities.

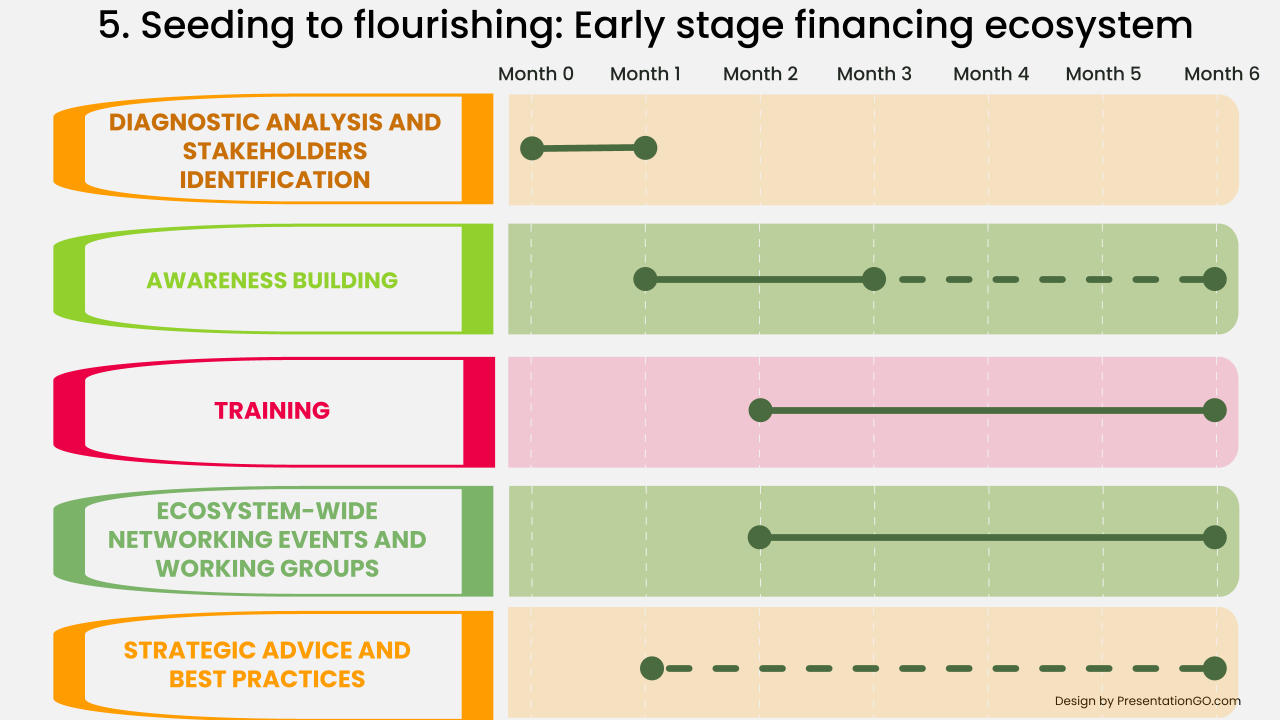

Seeding to flourishing: Early stage financing ecosystem

BENEFITS

This program serves as a catalyst for nurturing the early stage financing and investing ecosystem, fostering collaboration among angel networks, incubators, accelerators, and public-private partnerships to support diverse stakeholders, ensure founders receive crucial support, and contribute to overall economic growth and sustainability.

FEATURES

- Run a diagnostic analysis to understand the current state of the ecosystem and identification of stakeholders.

- Promote awareness building.

- Provide general training on Early Stage Investing or by specific stakeholder, including investors.

- Organize ecosystem-wide networking events and working groups on topics like the creation of syndication vehicles.

- Offer strategic advice on policy and regulatory matters, and share best practices applied in other regions to enhance ecosystem development.